Tax season has arrived!

While you’re gathering receipts, filling out forms, and stressing over how much you owe, you won’t have to worry too much about getting the proper documentation from your ShootProof account to give to your accountant.

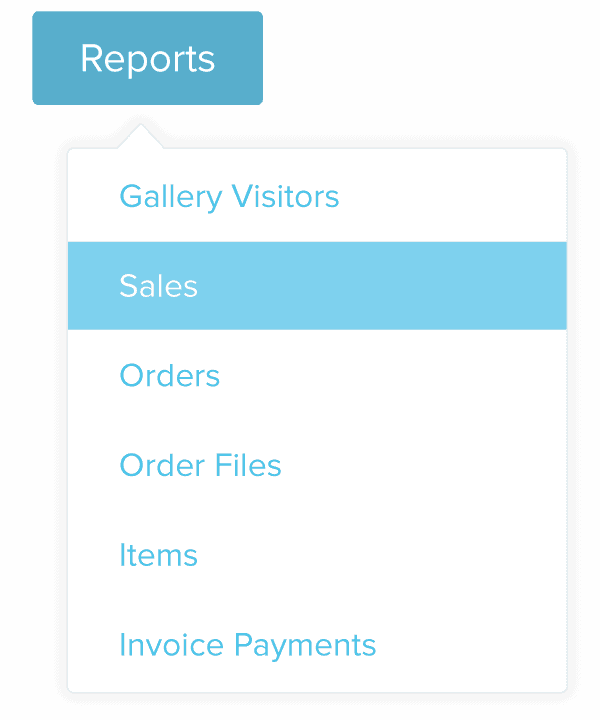

The Sales Report

You’ll find a comprehensive Sales Report when you click on Reports > Sales in your Studio Panel. Here, you can simply view the details of your sales organized by month, or you can download the entire report as a .csv file and open it in programs such as Excel or Google Docs, where you can then total specific columns, add them together, remove certain unneeded pieces, and more.

To view sales numbers from 2015, select that year in the dropdown menu on the top left. If you’d like a detailed explanation of what each column’s data is reporting, you’ll find a helpful list in the Knowledge Base.

Billing Receipts

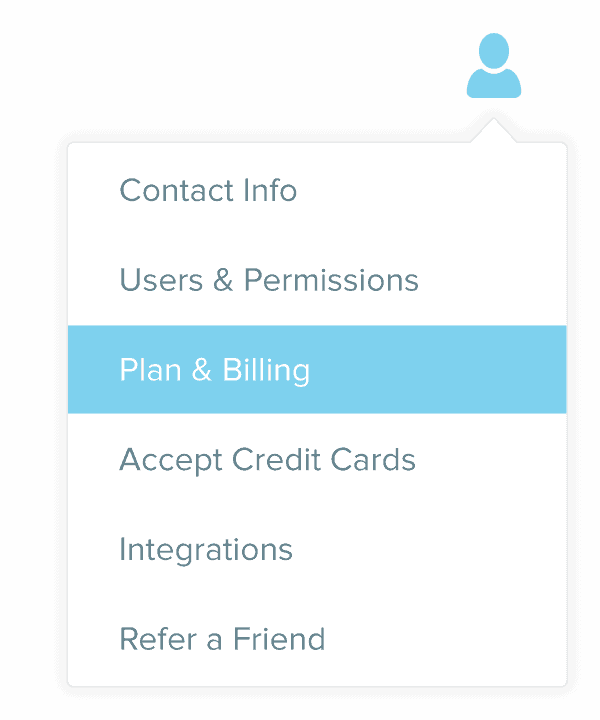

Is your CPA asking for receipts for your business expenditures? If so, don’t forget to include your ShootProof monthly or yearly plan bills!

You can easily view and print receipts for each payment you’ve made to ShootProof for your photo plan throughout the year by going to Account (that tiny head and shoulders button in the very top right of your account) > Plan & Billing and then scroll to the bottom.

Should I Receive a 1099K?

ShootProof mailed 1099K forms for any studio who had at least $20,000 in sales and a minimum of 200 profit transfers through ShootProof Payments by January 31, 2016 in accordance with IRS guidelines. For studios not meeting these IRS reporting minimums, no tax forms were generated or submitted to the IRS by ShootProof.

Still have questions? Contact the support team at support@shootproof.com for some assistance.